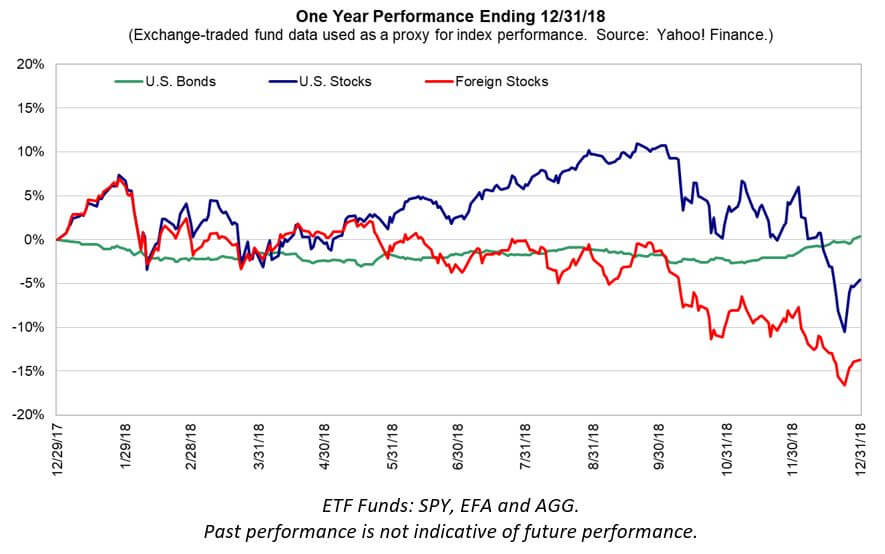

It is times like these that test the most stalwart of investors. As you have probably noticed this last quarter was tough for investors of all stripes.

Despite being a decade old, this has been the most “unloved” bull market ever. The severity of the 2008 recession kept many investors on edge, fearing bad news around every corner. But, through all that nervousness, the  economy made progress and stocks inevitably followed suit.

economy made progress and stocks inevitably followed suit.

The economy is still, despite worries of all sorts, moving forward. The volatility of the last quarter brought us within a whisker of having to declare the end of the bull market and the beginning of a bear market (declines of 20% are generally the yardstick). But, at least as of this writing, we’ve managed to hold off this distinctive event for some future time.

Economic Fundamentals

It is difficult to tell just what trajectory the economy and markets will assume in this brand new year. Sooner or later we’ll wake up one day and find that the next recession (mild may it be!) has begun. In the meantime, we’re left with tea leaves, crystal balls, the direction of the wind and, oh yes, fundamentals!

“Fundamentals” are what we wished all investors paid more attention to. Corporate earnings growth, valuation measures, leading and coincident economic indicators, and the growth in the economy are, primarily, the things that move markets over the long term. Yelling “fire” and running for the exits is not generally considered a fundamental measure of the health of the economy and markets although sometimes many will confuse one with the other.

It is important to note that fundamentals remain reasonably strong, even as stocks and other risk assets have fallen in value. In fact, the market decline has significantly improved one of those fundamental measures, namely valuation.

Mainstream economists tell us that the economy is still growing and, just as importantly, that it is likely to continue to do so for some time. Folks are working, unemployment is at historical lows, businesses are firmly in the black and earnings are expected to grow further, though perhaps not as quickly as they did in 2017 and 2018.

Volatility Driven by Uncertainty

So why was (seemingly) everyone selling? And why have stock and commodity prices fallen?

So why was (seemingly) everyone selling? And why have stock and commodity prices fallen?

The short answer (and perhaps the best answer) is that markets often behave like this in the short term. Over shorter periods, markets reflect the mood of the moment from day-to-day and month-to-month. The “cause du jour” this time is more nuanced, but if we had to distill it down to one word it would be “uncertainty.” The recent tariff regimen and fears of resulting trade wars has spawned uncertainty and, as it tends to happen, the uncertainty has multiplied to concerns about the price of oil, what the Fed will do with interest rates, and a number of other worries.

Longer-term however, markets are about the fundamentals. When these events happen they create better and more compelling valuations and, interestingly (absent subsequently verifiable reasons), better opportunities for those who are diversified and have the patience and fortitude to stay invested.

Portfolio Overview

As is our tradition for this time of year, below you will find a review of what is happening within each of the major asset classes in your portfolio: what they have done, what we anticipate going forward, and how we have approached each. Whether you are a long-time client or a recent addition to our client family, we hope you will find this helpful.

U.S. Bonds

Fixed income markets were challenged from several fronts in 2018. Short term interest rates have risen, which typically results in a more difficult environment for existing traditional fixed rate bonds; results however, were  mixed this year. While long-term rates also increased, they did not move as quickly as some had expected due to modest expectations for inflation. The net result was a slightly negative total return for broad bond markets for the year.

mixed this year. While long-term rates also increased, they did not move as quickly as some had expected due to modest expectations for inflation. The net result was a slightly negative total return for broad bond markets for the year.

Early in the year, we adjusted the mix of corporate vs U.S. government bond weightings in your portfolios, and we have also continued to maintain exposure to Floating Rate bonds with their low sensitivity to interest rate increases. Both moves helped boost returns in this part of your portfolio.

Foreign Bonds

Foreign bond returns were mixed as a strengthening U.S. dollar during 2018 acted as a general headwind for international investments of all types—especially fixed income, where absolute rates of return tend to be lower to begin with. While lackluster performance in this asset class can be attributed in one part to currency fluctuations, concerns over global growth and the increasingly charged U.S. / China tariff spat also contributed.

U.S. Stocks

U.S. stocks experienced substantially more volatility than they had the prior year, where every month had ended with a positive total return—a historical oddity. Instead, 2018 held multiple -10% price corrections and a substantially increased sentiment of uncertainty. While 2017 was a very strong year for stock returns, 2018 turned decidedly negative with the much-watched S&P 500 index dropping 6.2% versus a 21.8% gain for 2017 (as reported by Standard & Poor’s).

Early this year, we focused on reducing volatility by tilting this part of your portfolio away from more expensive growth stocks and towards more defensive positioning. In addition, we have continued to hold smaller amounts of small and medium sized company stocks than we would normally have in your portfolio as valuations there have been richer than we would like.

Early this year, we focused on reducing volatility by tilting this part of your portfolio away from more expensive growth stocks and towards more defensive positioning. In addition, we have continued to hold smaller amounts of small and medium sized company stocks than we would normally have in your portfolio as valuations there have been richer than we would like.

Foreign Stocks

In developed markets, slower growth in Europe and Japan, as well as a strong U.S. dollar, held returns below those of U.S. equities. On the positive side, such performance divergences between domestic and foreign equities over time have historically tended to normalize and eventually reverse, with foreign stocks currently in the position of holding the advantage of more attractive valuations.

Real Estate

This sector is especially sensitive to interest rates and the Fed’s rate increases had a dampening effect on the portion of your portfolio invested in real estate issues.

Commodities

Commodities lost ground in 2018, with the bulk of the asset class’ volatility stemming from extreme changes in the price of crude oil during the year.

Outlook

If you have been a part of our client family for long, you’ll recall the various discussions we’ve had in anticipating this market volatility. In previous quarterly letters, newsletter articles, blog posts and in-person meetings; we’ve taken every opportunity to discuss just how unusual the calm is, or was. Market corrections of various sizes historically happen quite frequently and it seemed we were overdue for a period of increased uncertainty and associated market decline.

Looking at the fundamentals, we see very attractive market valuations after the last several months of selling. The economy should remain supportive as GDP is widely expected to grow in 2019. Corporate earnings should follow suit by continuing to expand though perhaps not as robustly as we saw in 2018. It is likely that we will continue to have some jitters around the continuing trade tariffs and folks will hang on to the news out of the Fed in regards to interest rates.

The old adage tells us the “markets climb a wall of worry”. If we continue to see the sorts of fundamentals many economists project for 2019, we could very well see markets rise from what appears to be a discounted position to more in line with what one might expect given current projections for economic growth and corporate profitability.

Miscellaneous

- If you haven’t yet registered for our January 22, 2019 seminar at Illahe Hills Country Club, there are still a few seats left. Learn more by clicking here.

- Office closures during the first quarter of 2019:

- January 21 | Martin Luther King, Jr. Day

- February 7 | All-Staff Retreat

- February 18 | President’s Day

Thank you for your continued confidence and business. Happy New Year!