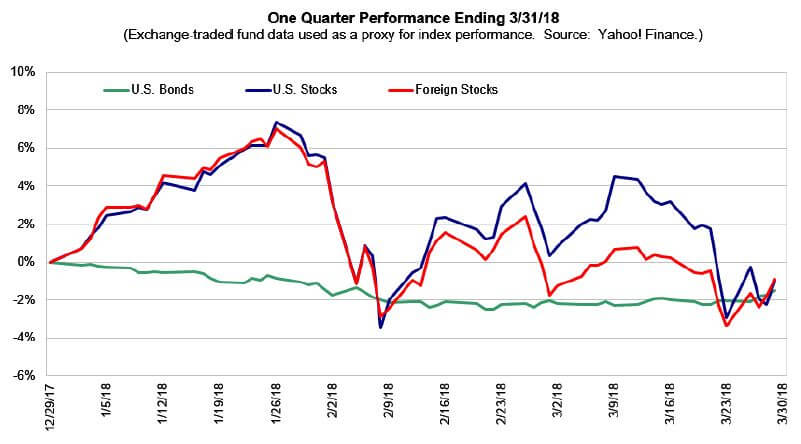

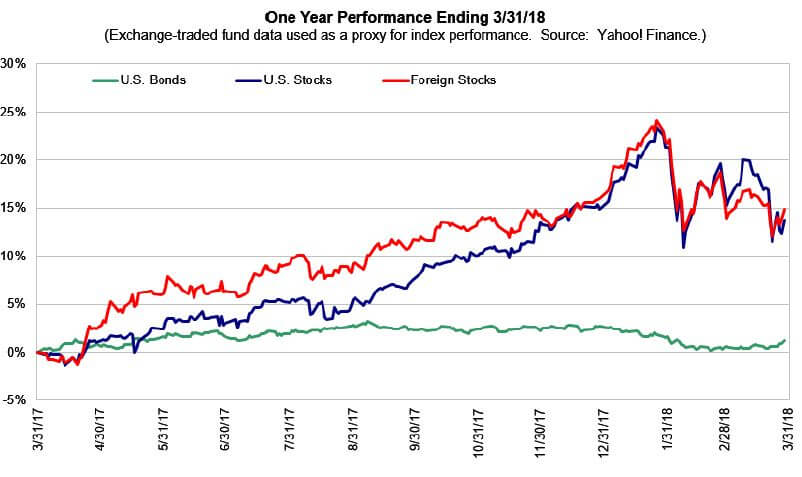

We’ve spent the last 6-12 months telling you to anticipate an increase in market volatility. We have a feeling many of you were recalling those conversations as you rode through the market volatility of the last quarter. For the first time since June 2016, the financial markets experienced a correction followed by a pullback a few weeks later.

In our 2017 Q3 update, we emphasized that market volatility is normal and should, for the most part, be taken in stride. The market has been a boiling pot for a couple of years now and benefited from blowing off some steam. Pullbacks and corrections help to bring market valuations back to normal levels.

Top 3 Investment Questions of Q1

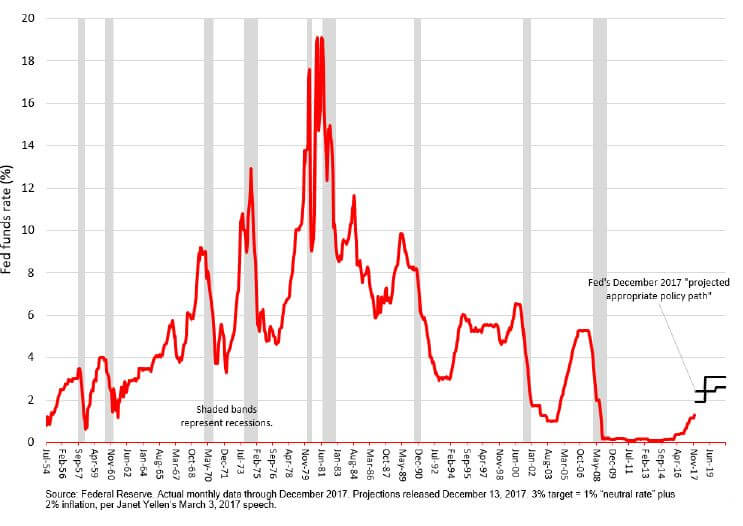

1. How will the Fed, inflation and interest rate increases impact my portfolio?

The Fed plays a very important role in determining the direction of our economy and by proxy, the markets. They need to raise interest rates to normalize markets and broaden the options required for healthy monetary policy. If they do so too quickly, they could expedite the next recession by stunting growth and negatively impacting investment earnings and employment. If they move too slowly, inflation could spin out of control or build a bubble into the market. It’s a delicate balance.

In late 2017, the Fed announced its intent to raise interest rates gradually; 3 times this year and 2 times/year for the next two years. This is in line with what we’ve heard from the Fed for several years and offered some continuity in the transfer of power from Janet Yellen to Jerome Powell. Strong economic and labor data helped to drive the decision to move forward with the highly anticipated 0.25% rate increase earlier this month (making the new range 1.50 – 1.75%). Q1 has offered up steady growth, fiscal stimulus and low unemployment. These things together have economists wondering, will Powell stick to the ‘slow and steady’ plan? At this point, there doesn’t seem to be any reason for the Fed to change their forecast.

You might have heard the relatively murky description that the correction in early February was caused by ‘inflationary fears.’ Here’s how minute a fear has to be to make the markets jump: 0.3%. That’s the difference between what economists predicted for wage growth and what was reported. For quite some time, the globalization and automation of our workforce has kept wages relatively low, which in turn has kept inflation down. Short and long term inflation forecasts have been in the 2% range. The recent report estimated wage growth at 2.3%. Bigger paychecks means more money in the pockets of consumers. More money on the street means businesses can charge more for their goods. Price increases mean inflation. If you sprinkle in the snapshot of stock earnings, tax cuts, business activity and economic fundamentals, you could have the makings of real, actual, bonafide inflation. Or not. But the smell of it was enough to set investors off.

2. When will we know we’re headed toward the next recession?

Something that we really appreciate about you – our clients – is how frequently this question is phrased with inevitability. You know and understand that recessions are part of the economic cycle. Of course, knowing that you have to get a vaccination and actually getting the vaccination are two different things. Here are a couple of pieces of economic data that we’re particularly focused on.

The yield curve and recessions

Under the last question, we addressed inflation and how the rate at which it increases can impact the financial markets. Another indicator is the yield curve. In our yearend report and Q4 update, we talked about the flattening of the yield curve as one of the indicators that commonly precedes a recession. Under normal circumstances, short term interest rates will pay less than long term interest rates. The yield curve hasn’t changed drastically since our Q4 update. It’s still positive, though not as inclined as it has been. If short term interest rates rise too quickly, that can flatten the yield curve. What seems more likely is an upward shift of the entire yield curve, meaning that interest rates and inflation will increase in tandem, moving the entire curve upward, but not impacting its shape.

3. What’s with the market volatility and what should I do about it?

One could be forgiven for thinking that the markets – and more accurately, the media outlets covering them – have multiple personality disorder. On Thursday of last week, news headlines blared “Stock market on the brink of meltdown.” Three days later (two of them being weekend days when markets are closed), headlines announced “Dow posts biggest one-day point gain since 2008.” What’s an investor to think?

We’ve already covered monetary policy and its connections to the correction in early February. The most recent dip came after words (and tweets) were exchanged regarding international trade tariffs. Initially, the tariff conversation was around imports of steel and aluminum. Last week, President Trump announced a $60 B tariff on Chinese goods, which would have a significant impact on China’s ability to invest in the technology sector of the US. China responded with a proposal of tariffs on US agricultural products.

What should you do about it? You should invest. If you have extra money in cash, get it working for you during times of market dips. The happiest clients we have are those that can look to market volatility with the eager anticipation of investing, rather than the anxious fear of seeing the down arrow on their monthly Fidelity statement. Stay focused on the things you have control over.

Portfolio Commentary & Outlook

The last quarter proved to be a continuation of what we’ve been doing for the past 12 months: removing unnecessary risk and selling growth assets during market highs. Coming out of the recession, it made sense to invest in high yield bonds and growth sector stocks. As this bull market pushes the record on length, it’s become clear that in some cases, the return is not worth the risk. Over the past year we’ve taken strides to unwind some of those positions and by doing so, removed another layer of risk. We continue to make valuation a cornerstone of our decision making when evaluating the funds in your portfolio. Aside from a general rebalancing we did in mid-January, here’s a brief rundown of each asset class and our strategy looking forward.

Fixed Income

As you know, bonds are valued like a see-saw. As interest rates go up, the price of bonds goes down. The rise in interest rates along with the fears of inflation and more aggressive policy from the Fed made for a difficult quarter in fixed income. Thanks to our overweight toward US corporate debt and floating rate bank loans relative to US government bonds, we earned some performance during this challenging time. That said, your foreign bond holdings did better this quarter, which include a variety of emerging markets and currency exposures. We’ve found that by diversifying your fixed income investments (government, corporate, emerging and developed markets) portfolios land in a sweet spot of stronger potential returns and reduced risk.

Equities

We had two themes this quarter in your equity positions: 1) invest more in value-based stock than in growth stock, and 2) move assets away from traditional equity exposure and toward dividend paying investments and buy-write covered call holdings. The goal of both was to provide a buffer against market volatility, which they did. Large cap US equity holdings experienced the wildest swings of the market volatility this quarter, but our move toward value-based stocks helped to temper that somewhat. Mid-cap portfolios are split between growth and value based approaches and faired quite well last quarter. Small-cap stocks saw the best performance in their growth sectors. Foreign stock experienced much of the same market volatility that US Stock did, as interest rates and potential tariffs impact everyone in this global economy. Looking forward, with the growth nations of Japan, Europe and the emerging market regions picking up steam as the US dollar weakens, it’s possible the US stock market will take a back seat to foreign equity.

Alternatives

US real estate suffered this quarter due to fears of higher interest rates while foreign real estate fared far better. (Are you starting to understand what we said earlier about the Fed and their power to impact various sectors of the economy and markets?) Over the long term, real estate does well during times of sustained economic growth and higher inflation. It seems holding less conventional and foreign real estate continues to look promising. Commodities are a good diversifier because they don’t tend to correlate with the broader equity or bond markets. As such, they have a variety of factors that influence their value. Oil prices have been driven by uncertainty around the pace at which OPEC nations may produce. Natural gas declined some due to weather effects. Metals suffered after the global trade tariffs were proposed. These holdings tend to do well in the latter part of the economic cycle and during times of higher inflation.

Miscellaneous

We’d like to invite you to an upcoming event. We are proud to cosponsor and cohost Women’s Worth, a free financial and estate planning seminar designed exclusively for women. It will be an interactive conversation where we’ll tackle topics unique to women’s planning issues. We hope that you (or a friend, mother, daughter, colleague) can join us.

We’d like to invite you to an upcoming event. We are proud to cosponsor and cohost Women’s Worth, a free financial and estate planning seminar designed exclusively for women. It will be an interactive conversation where we’ll tackle topics unique to women’s planning issues. We hope that you (or a friend, mother, daughter, colleague) can join us.

Women’s Worth | April 24, 2018 | 330-630pm | Illahe Hills Country Club

Register →

Thank You

In times of market highs and lows, you continue to trust and rely on us. This is not a responsibility we take lightly. Thank you for your continued confidence, business and referrals. We appreciate you!