Happy summer!

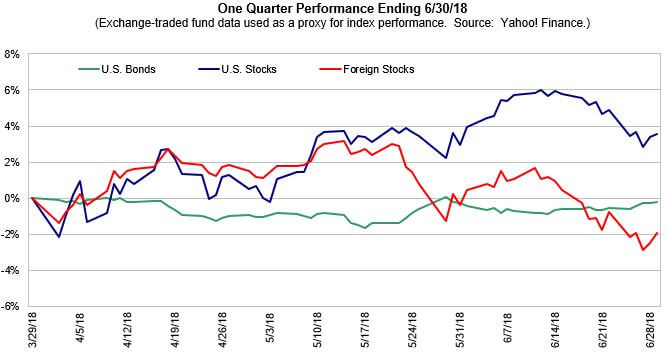

The second quarter of this year brought with it some more of the volatility we experienced in Q1. While the market movements weren’t as wide as the first quarter, political rhetoric and interest rate changes continued to keep them bouncing throughout the last three months.

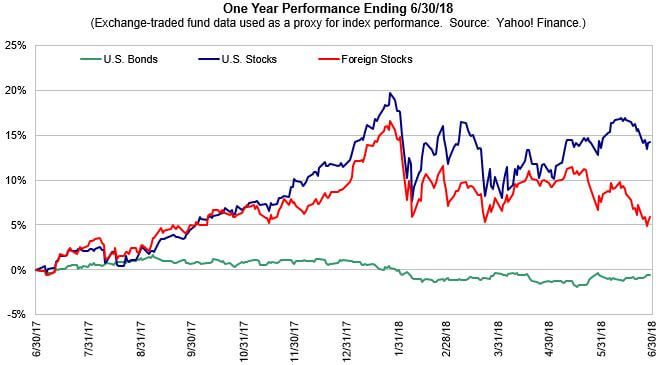

When we step back to look at the last 12 months, we get some perspective as to just how calm things had been (unusually so!) up until February of this year.

Economic Optimism and Market Volatility

There is a lot to be positive about as we look out at the economic landscape. Corporate profits have grown steadily over the last year and we’re expecting more significant growth ahead. Well into a nearly decade-long economic recovery, U.S. stock earnings were given an immediate boost at the end of last year with tax reform pushing rates of growth substantially higher. While forward-looking earnings growth will not necessarily be as robust as the initial impact of tax savings wears off, growth has continued and may remain in the high single-digit or low double-digit range for another year or two based on mainstream economic analysis.

On Main Street, the economy is stronger than we’ve seen it for many years. Folks are back to work, unemployment is at record lows, and businesses are expanding and hiring to keep up with demand. This is the real secret to the economy. All over the country–in fact all over the world–people are trying to make better lives for themselves and their families by growing their businesses, upgrading their skills for better opportunities, and purchasing the goods and services needed for these endeavors.

Of course, there are plenty of things to worry about as well. One big concern of late has to do with tariffs levied on foreign goods. Already, one set has been implemented and a larger new set has been announced. After many decades of working to further free trade, we are now taking steps in the other direction. The administration indicates this will protect American businesses and that this is needed to further our national security.

The worry is that these actions will lead to an escalating round of tariff policies and that these extra costs will cause a drag on our own economy as people and businesses pay more for raw materials and manufactured goods. Only time will tell what the economic impacts of these policies will be, and that uncertainty is unsettling to markets making it hard for companies to do long-range planning.

We’ve seen a bit of that uncertainty play out with share prices since February. So far, this year has certainly been a bumpier ride than the smooth sailing of last year. We would expect more volatility in the months ahead as the markets debate tariff regimens, rising interest rates and their effect on economic growth and stock valuations.

What’s an investor to do? Diversification, coupled with a disciplined approach to asset class weightings, continue to offer the best methodology for minimizing volatility while remaining invested in order to participate in the gains of the markets and economy.

Portfolio Overview

Equities

We have seen this volatility in action as we think about asset class results so far this year. Many would be surprised that US equities are modestly positive year-to-date. However, their international counterparts have not been as beneficent to U.S. investors as a rising dollar has reduced returns to holders of those stocks here in the U.S. Interestingly, developed markets outperformed developing markets; this likely due to tariff fears. Real estate has had a great quarter after its lackluster performance in 2017, and commodities continue to lead, mostly due to higher oil prices.

Fixed Income

Year to date, bonds have had a less than robust showing as a focus on rising U.S. interest rates put pressure on fixed income prices. This has been the most anticipated set of interest rate increases as we languished near zero on the short end for many years. So while rising rates have impacted bonds, the reaction to the rate increases thus far has been relatively modest. Longer term, this is a positive as it gives the Fed room to move during the next slowdown and also increases yields for bonds, which bodes well for this part of the portfolio in the years ahead.

We made some changes in your bond holdings last quarter, normalizing the percentages allocated to corporate bonds versus U.S. government bonds. For many years corporate rates have been advantageous, but the spread between their rates and that of U.S. government bonds has narrowed. As such, we think this change in relative weighting, while modest, is a step in the right direction.

Outlook

It is impossible to tell what the future holds, but we are optimistic with the economy still growing along with inflation and interest rates at reasonable levels. There continues to be no sign of recession even as market pundits sharpen their gaze on the horizon ahead with this economic recovery in its 10th year. We have taken steps in both fixed income and equity positons to reduce volatility, and we think your portfolio is well positioned give the current environment.

Thank You

We never get tired of saying it: thank you for your continued confidence and business. We hope this summer finds you enjoying the warmer weather, with more free time to do the things you love with those you care about.