As if markets hadn’t produced enough volatility already in recent weeks, this morning’s initial drop of -7% triggered stock exchange circuit breakers—a computer system intended to temporarily stop trading activity, with the purpose of stopping a free fall in prices that can be exacerbated by algorithmic trading.

What changed? There have been more coronavirus cases, which has kept investors on edge, but the newest element is an oil price war. There are several global price measures that interact with each other and serve as a gauge to whether economic growth is strong or weak. These include interest rates (particularly the 10-year U.S. treasury bond), stock indexes, as well as those for key commodities like crude oil. Absent fears over supply disruptions due to geopolitical events, such as in the 1970s, oil prices tend to find a natural home at the intersection of supply and demand. While week-to-week price movements tend to be driven by supply, through rig counts and inventory reports, longer-term demand has tended to be more consistent. The emergence of U.S. and Canadian shale as key sources has raised supply significantly in recent years and caused the situation where the U.S. is now viewed as the world’s ‘swing’ producer—the marginal producer able to tweak supply and thus retain the highest level of pricing power. This used to be Saudi Arabia, which has been relegated to a more difficult position. On one hand, they can produce oil easily and with the world’s lowest production/operations costs per barrel, so they can still make a profit on lower oil prices. However, a disproportionate amount of the Saudi government’s fiscal budget is based on oil revenue, so lower oil prices beget lower receipts. Based on growing expenditures, it’s been estimated that oil prices need to remain relatively high in order for the country to maintain a balanced budget.

In recent years, this pressure has begun to weigh on OPEC, of which the Saudis are a key member—with member nations disagreeing on whether or not to cut production in an attempt to lower prices by raising supply. Members such as Russia are less enthusiastic to this approach, as they, like the Saudis, depend on oil revenue as a large source of budgetary inflows. This came to a head this weekend, as Saudi calls for production cuts were met with additional resistance by the Russians. In turn, the Saudis reversed course, by announcing plans to help drive oil prices as low as possible to call everyone’s bluff, so to speak. Naturally, this would likely be a short-term measure, as it’s in producers’ best interest to keep oil prices at a functionally profitable level long-term.

The negative side of this is that it pulls down profits for energy companies; however, these represent less than 5% of the S&P currently by market cap. While lower oil prices do correlate to higher recession fears and overall lower economic growth, they have been self-correcting to some extent. In essence, lower oil prices incent more oil usage, which creates higher prices. In an uncertain economic environment due to the impact of the coronavirus and open-ended slowdowns in factory activity and consumption, taking the pressure off of consumer and business budgets through lower energy costs could be a positive development.

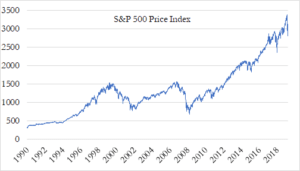

Despite the dramatic headlines and chaos-oriented news coverage, the chart below is important to remember for its long-term perspective. Despite virtually no earnings growth, U.S. equities gained over 30% in 2019, which pushed valuations to richer levels than their long-term averages. We’ve surpassed the -15% decline level from the market peak in mid-February, but have not yet achieved a full -20% bear market. It’s important to remember that, while -10% corrections have tended to occur once a year on average, declines of -15% to -20% have occurred at least twice a decade. (The last -15% drop was not quite that long ago, culminating in December 2018, but the prior was in mid-2011.) For longer-term investors, these types of dramatic market events represent fairly small blips on the radar screen compared to the multi-decade trend.

This market downturn is far less ‘mysterious’ than some financially-driven price declines in the past, such as the global financial crisis. A lack of understanding, transparency, and liquidity contributed to that decline as much as any negative growth effects. In this case, uncertainty is again the culprit, but this appears to be more so about the length and depth of the economic slowdown than the severity of the virus itself. Healthy markets do not move straight up forever and pauses often provide an opportunity to reset pricing and expectations to more realistic levels.

Source: Yahoo! Finance