Today, Janet Yellen attended her last meeting of The Fed as chair. As anticipated, it was uneventful with no increase to interest rates for the time being, keeping short-term rates to a targeted range of 1.25-1.50%. New chairperson Jerome Powell will take the helm at the next meeting in March.

As they do after every meeting, The Fed released their official statement. In it, they noted labor markets and economic activity continue to strengthen as has employment and household / business spending. Inflation, however, is running at a sub-target pace despite recent progress. Overall the assessment appeared largely positive, which points to the potential for another rate hike in March. (If you’re looking for a refresher on The Federal Reserve Board, revisit our November blog post here.)

Here’s a breakdown of the relevant policy items discussed and reviewed at today’s meeting:

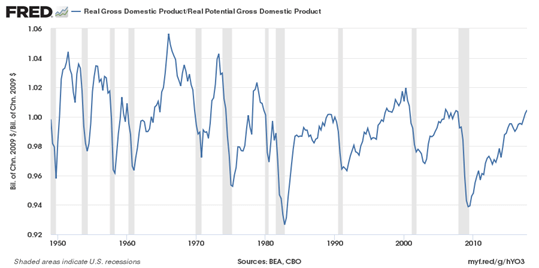

Economic growth: Preliminary reports for Q4 growth came in at 2.6%. That’s considered decent in the context of the past several years, but not as strong as the expected 3.0%, or the 3-4% growth rate touted by the administration as highly achievable over the coming year. When looking at current GDP levels relative to ‘potential GDP’ we are indeed running higher. At this point in the business cycle, this is not uncommon. Politicians are excited by this news but economists realize that a growth pace that is ultimately ‘too hot’ begins to run on borrowed time. Tax reform added an extra boost to growth and company earnings that was taken by markets as a welcome shot in the arm.

Inflation: Core CPI has been running at just under the 2% Fed target. With price levels/inflation being one component of the Federal Reserve’s mandate, current readings argue for a relatively neutral policy stance, with pressures not underwhelming or overwhelming. Debate continues here, too, about the practical definition the Fed’s ‘target’—as to whether it should be an overly-specific (or even rules-based) quantitative goal or merely refer to a long-term trend.

Employment: Labor conditions are running hot. Over the next 11 months, the Fed’s thoughts could turn to how long this labor winning streak can last and what a pullback might eventually look like.

Conservative experts anticipate around two rate increases in 2018, spaced out to June and December. The Fed itself has anticipated three, and more aggressive ‘bulls’ are assuming four this year. Of course, this all depends on the continued robustness of the economic expansion and the accompanying pick-up in inflation that is generally expected to coexist (although we’ve been waiting some time for this). There are peripheral issues in the bond market as well, including the gradual balance sheet run-off of U.S. treasury holdings which we wrote about last year. This adds to supply, as will deficit spending to finance the recent tax cut. Thus far, any supply issues that would have resulted in higher interest rates have been tempered to some degree, with rate increases coming as a reaction to stronger economic growth. Bond yields are unpredictable, prone to changes in near-term news, and thus very difficult to forecast. The inflation that would send rates soaring has been persistently absent, and the unique demand from foreign buyers has been exceptionally strong.

On the investment market side, the flatter yield curve has been one of the more discussed treasury market dynamics of the past few months. However, as long-term yields drive higher, actually steepening the curve and alleviating these concerns, other worries about the effects of rising interest rates surface. Rates that are deemed ‘too high’ can be the trigger of the avalanche by suppressing growth. For now though, overall conditions remain quite solid. Earnings growth has been an overwhelmingly important driver for equity returns over time, with foreign prospects continuing to look even more interesting than domestic.

As always, our investment team will keep an eye on the Fed, the markets and the economy, doing what we can to best position our clients and their portfolios proactively.