What has been/will be the impact of the coronavirus on the global economy and markets?

The spread of the new coronavirus has taken over the headlines and hijacked market sentiment in recent weeks. Thus far, through available medical data, it appears that while the virus appears more contagious than the similar SARS epidemic in 2003, it is less lethal. The fatality rate for the coronavirus has been 3% or so thus far, relative to 9% for SARS at its peak.

The idiosyncratic elements included in such events—such as the World Health Organization declaring China’s surging infections a global public health emergency, the Russians closing their land border, and drastically reduced air travel—all added to market worries. The week ended with more questions about the level of contagion, and lethality, as a few hundred travelers from the Wuhan epicenter, were quarantined in California, which is the first such domestic action in decades.

From an economic standpoint, it appears that the global economic growth pace could be reduced by as much as 0.5-1.5% for Q1, based on best estimates, if conditions peak and recover similar to past experience. In the worst case, this may lengthen the period of global growth slowdown experienced and defer a recovery into mid-year or a bit beyond, as opposed to earlier 2020. This growth impact mostly impacts China, due to reduced travel, but also a slowdown or stoppage of domestic consumption, including entertainment, such as restaurants and consumer goods. This could affect large multi-national brands, but also any company sensitive to general business conditions, as well as energy commodities.

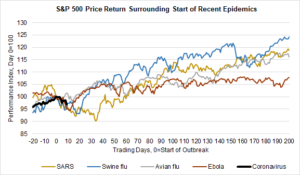

In reviewing several previous episodes of epidemics, including SARS (2003), Swine flu (2009), Avian flu (2013), and Ebola (2014), financial markets reacted negatively in a similar way. On average, equities troughed about four weeks after the initial panic. In each of these cases, they recovered back to around where they started before the panic in the subsequent few weeks (and moved higher than that in several cases) by two months after the initial event. History doesn’t always repeat, and every contagion is a bit different, but such similar epidemics were proven to have been short-lived blips on the financial radar screen.

Source: FocusPoint Solutions calculations, based on index returns from Yahoo Finance. Epidemic start dates: SARS (1/21/03), Swine flu (6/11/09), Avian flu (3/31/13), Ebola (9/30/14), as defined by Goldman Sachs Investment Research. Coronavirus start date set as 1/17/20, with returns through 1/31/20.