Happy Summer! The longest and warmest days of the year are here. The gardens all around town are beautiful, with riots of color against a backdrop of verdant green.

In sitting down to write this, we thought about simply changing the date on last quarter’s letter and sending it out again. While a lot has happened, we find ourselves in much the same situation. It seems we’ve run so very fast to simply stay in the same place! The economy is still chugging slowly along, the Fed has not changed rates, the capital markets have been positive and the folks in Washington are still bickering about most everything.

If we dig a little deeper though, we’ll start to see some nuance in the various measures. Last quarter we touched on some of the metrics we follow, so let’s revisit those briefly now.

International Trade

International trade continues to be a scrutinized area, and this quarter certainly had its share of dramatic developments. While April saw continued optimism about a China/US trade pact, May brought renewed fears as talks with China deteriorated and the Mexican tariffs were announced. Markets reacted as would be expected with nervous selling and renewed fears of a global slowdown. Just as quickly though, the Mexican situation was settled and, hope springing eternal, June saw a rebound in stock prices that brought equities to their best first half-year in quite some time.

US Economy

In contrast to the sometimes-frenetic activity on Wall Street, life was a bit calmer on Main Street. Measurements of the Leading Economic Indicators flattened out a bit but remained positive overall for the quarter, signaling continued modest growth in the economy. We are not growing as quickly as we did a couple of quarters ago, but we are growing nonetheless.

Interest Rates

Last quarter, the big news in interest rates was the pause in rate increases by the Fed. This quarter’s activity was in longer dated maturities whose rates have fallen precipitously over the last several months. The inverted yield curve (where short-term bond yields are above longer-term bond yields) we discussed last quarter is proving persistent and this much-watched sign of slowing is signaling a pessimism about the longer-term prospects for the economy. It is important to note that while most modern recessions have been preceded by an inverted yield curve, not all inversions have resulted in recession. This unusual situation could be changed by the Fed lowering short term rates, by renewed optimism causing longer rates to rise or by some combination of the two.

The Markets

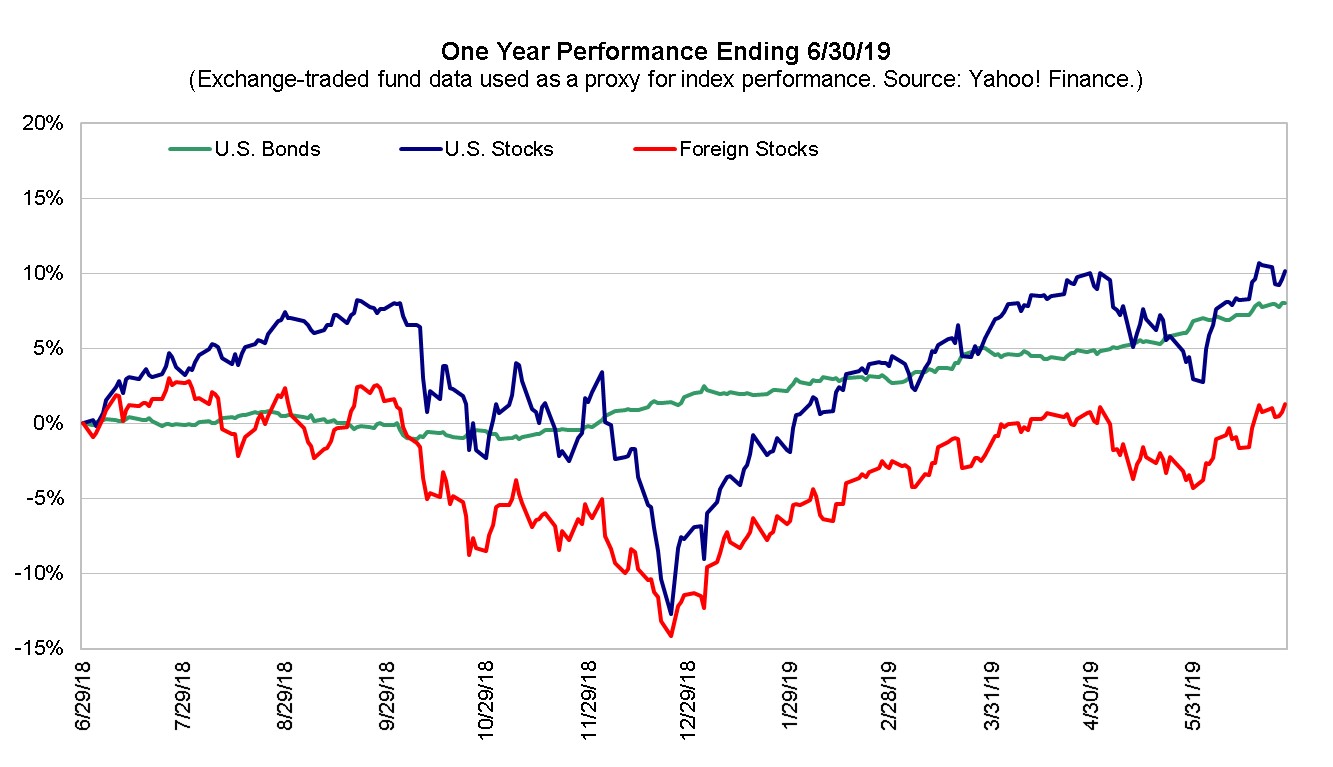

From a portfolio perspective, this last quarter was quite robust. US stocks led the pack, but international equities turned in a strong showing as well. Perhaps more ephemerally but welcome, nonetheless, was the strong showing from US and international bond markets as yields fell, pushing up the prices of many sorts of bonds significantly over the quarter. Diversified portfolios turned in a respectable gain overall with only commodity exposure losing ground over this period. We made no substantive changes to holdings or portfolio weightings.

Summary

Likely, most of us are hoping the remainder of 2019 remains uninteresting. Somehow, that seems unlikely to occur. Tariffs and the discussion thereof will keep the economy in the forefront; the Fed’s moves, along with the pace of global growth will certainly gather attention as well. We can take comfort that diversified portfolios have historically lagged the best performing asset classes on the upside but lost a lot less ground in times of turmoil.

We hope the rest of this year is fruitful for you and your family, and that you get to enjoy the best of what summer has to offer. We appreciate your continued trust and confidence.