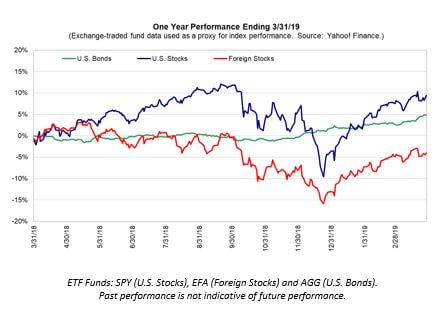

What a difference a few months can bring. The fourth quarter of last year was sure a tough one, with uncertainty and general angst pushing prices down significantly. The first quarter of 2019 was quite the  opposite. Such is the topsy-turvy world of capital markets and the investment risk that goes along with them.

opposite. Such is the topsy-turvy world of capital markets and the investment risk that goes along with them.

What has changed? Progress on international trade talks has helped. Investors have more reason to look for a normalizing of policy after a period when the threat of tariffs made people feel pessimistic about the direction of the global economy.

The Fed switched gears and held off on further rate increases due to concerns about slowing growth in the domestic economy. Slower growth ought to be a negative, but this slowing has been expected for some time as the bump from the tax act receded into the distance.

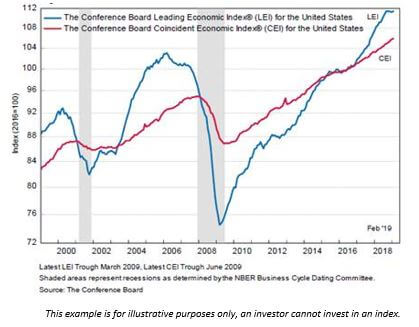

Economic Indicators

The economy keeps on (slowly) chugging along. Last month, the “leading economic indicators” resumed their march upward after five months of relatively little change. Those economic measures help us understand just how the economy is doing and provides some predictive activity for the future. Composed of 10 different parts (including retail sales, building permits, manufacturing activity, inventory levels and the stock market), this index gives us a sense of where we are headed.

There are also a set of “coincident” indicators. These tend to give us a snapshot of where we are. The set of “lagging” indicators tell us where we have been.

Just like other economic measures, the pace of growth in the leading and coincident indicators has slowed versus the prior period. This is another reminder that while growth is positive, we are still in the same slow-growth mode that has generally characterized this economic expansion.

Last month marked the 10th year of the current expansion. It would sure be handy to know when the next recession will arrive and what sort of recession it might be. Of course, we don’t know this. No one does. In the meantime, we’ll keep an eye on the indicators and investment risk. We’ll continue to analyze value in the marketplace to help make good decisions in our overall discipline.

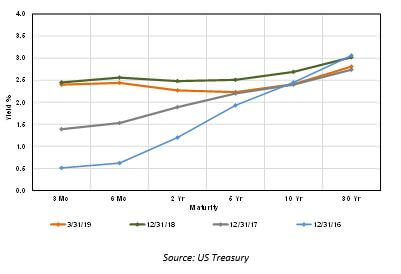

Yield Curve

Another measurement that has garnered some attention recently is the yield curve. The “yield curve” is a description of the relationship between longer and shorter term interest rates of government securities. Normally short term rates (T bills and shorter debt obligations) have lower interest rates than longer dated maturities. In other words, folks generally earn a higher interest rate for longer dated bonds than for bonds that mature fairly soon.

Every so often, the rate on longer term debt falls, or that of shorter term debt rises and that relationship gets knocked out of kilter. Over the past few years, we’ve seen both. While the Fed pushed upward on short rates, the market (where longer term rates are set by the buying and selling of bonds) pushed intermediate rates lower. The result was an abnormally shaped yield curve with almost a flat line, showing that shorter-term rates and the 10-year rate was almost the same value.

Every so often, the rate on longer term debt falls, or that of shorter term debt rises and that relationship gets knocked out of kilter. Over the past few years, we’ve seen both. While the Fed pushed upward on short rates, the market (where longer term rates are set by the buying and selling of bonds) pushed intermediate rates lower. The result was an abnormally shaped yield curve with almost a flat line, showing that shorter-term rates and the 10-year rate was almost the same value.

This sort of flat (long and short rates at essentially the same value) or inverted (longer rates actually lower than short rates) yield curve happens when expectations for growth aren’t robust.

Growth implies inflation and inflation makes bond holders want higher interest rates to counter that inflation. The lack of inflation expectations does just the opposite, reducing the interest rate needed. Concerns about the robustness of economic growth in the future push interest rates down and bond values up (the old bond teeter totter between rates and values).

Flat or inverted yield curves aren’t an indicator of strong economic growth ahead. In fact it is just the opposite; those curves tell us there are doubts about the economy’s ability to grow. Generally this tends to be not as concerning over the short term. It is generally a sustained period of inversion (long rates lower than short rates) that acts as a predictor of a nearing recession.

Outlook

Amid this talk of growth and recessions, it’s important to remember that both are part of the normal economic cycle. They aren’t quite as predictable as the seasons, but just as certain. In the fall, as winter approaches, the prudent person will get their firewood in, check their storm shutters and make sure they have proper tires and an emergency kit stashed in the trunk. Likewise, the prudent investor will want to make sure they have made the needed preparations in their financial lives by diversifying appropriately. This means assuring they have enough in bonds or other short-term investments to tide them over until spring sends its inevitable shoots through the snow. For now though, the economy is growing and it looking more like spring.

Miscellaneous

We are again proud to cosponsor and cohost Women’s Worth, a free financial and estate planning seminar designed by and for women. We hope that you (and/or a friend, mother, daughter, colleague) can join us. While the event is free, registration is required. April 23, 2019 | 5-7pm | Illahe Hills Country Club. Register here.

Thank You

During this season of renewal and color, we hope you find time to foster the relationships that you cherish and activities that fulfill you. Thank you for your continued confidence and business. We appreciate you.