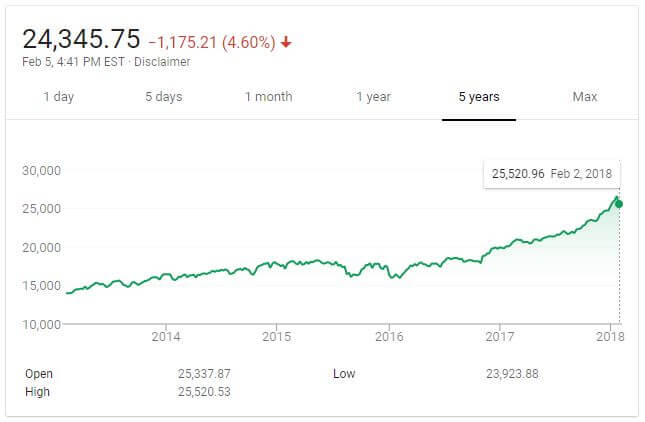

For the last several months, the USA Today insert in the local newspaper has had an ever-shrinking, almost non-existent “Money” section. I’d wager to guess that may not be the case in tomorrow’s edition. Today’s news of the Dow Jones Industrial Average dropping over 4% echoes loudly in the empty news space the bull market has created. While it’s true that the Dow dropped 1,500 points, remember that it’s grown to over 25,000 points – up nearly 30% in 2017 alone! A thousand points today now represents only a few percentage points of the index as a whole.

As Certified Financial Planners, we’ve been expecting this (and more) volatility for several months. Our client families have heard that pullbacks and corrections are part of a healthy market cycle, that it’s been over 2 years since we’ve had one and that historically speaking, we are due. Market pullbacks (defined as a 5-10% drop) and corrections (defined as a 10-20% drop) tend to bring over-enthusiastic markets back down to earth. The last time we saw a drop of -5% was back in June 2016. Remember Brexit? Talking about -5% to -20% market drops may have you queasy, but you’ve lived through it. With the last 100 years of market history as our guide, pullbacks of -5% are expected about once a quarter. Corrections of -10% are expected about once a year. -15% drops usually happen every other year. With that perspective of history in our minds eye, it’s clear we’re on borrowed time.

The more borrowed time we’re on, the more sensitive the markets are. This time around, the catalyst for this volatility appears to be interest rates. The Fed met last week in what was an uneventful meeting on its face, but what seems to have reminded investors of just how low interest rates are, just how high the stock market is and just how long this bull market has been running. The strength of the economy, stock earnings, fundamental conditions, tax cuts and business activity help to drive the markets in many ways; however, they can also drive inflation. Couple that fear with data released last week showing an increase in hourly wages at the fastest rate since 2009, and we saw a selloff in the bond market.

With the recent emphasis on how well the economy and markets are doing from both the administration and the media, this market volatility serves as a good reminder of why it’s important to keep your nest egg diversified. It’s tempting in times of market high’s to follow the crowd and think you’re a part of the upswing. But for most investors, by the time they jump aboard, the largest gains have already been made.

Still feeling angsty and want to take some action? If you have some extra cash laying around, think about getting it working for you in your investments. The ‘buy low and sell high’ theory sounds great on paper, but it takes a smart investor with guts to do it.