The Federal Reserve Open Market Committee made no changes in monetary policy today, keeping the target short-term interest rate at 0.00-0.25%. The official statement was little changed in substance, with wording about the hardship caused by the Covid-19 pandemic replaced by the improvement due to wider vaccinations.

The most recent Fed member estimates (seen in the ‘dot plots’) point to a greater chance of a rate hike or two by 2023 than the previous March plot. (This realization caused a quick stock market drop.) To put it into perspective, a fed funds rate of 0.25% or 0.50% a few years from now still counts as quite accommodative, even if not the zero of today. The clustering of longer-term fed funds rate expectations remains around 2.5%. This implies, assuming the 2.0% inflation target is achieved and maintained, a real yield of 0.5%. This is below the multi-decade historical norm of about 1.0% for cash, but certainty an improvement on today’s minuscule yields (welcomed by savers), even if it takes time to get there.

The key question is when will the ‘tapering’ off of ongoing $120 bil./mo. treasury and mortgage bond purchases begin? ‘Talking about tapering’ has been the much-talked-about first step, followed by actually doing it. Hardly anyone thought it would happen at today’s meeting, but the timeline has certainly moved earlier after the strength in recent months. Only once tapering goes on for a while will rates likely start rising. Interestingly, based on CBOE fed funds futures, the probability of no change today had fallen to 93%, with the remaining 7% betting on a quarter-point increase. These odds remain consistent through December.

Most of the Fed’s metrics are showing improvement, as seen in many data releases:

Economy

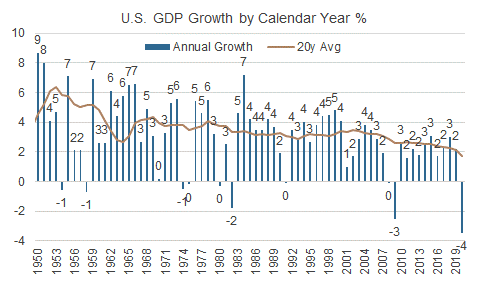

After a notably bad 2020, growth in 2021 is expected to rebound into the mid- to upper-single digits (the Fed estimate has improved from 6.5% to 7.0%). The following years of 2022-23 remain cloudier, remaining dependent on the path of vaccinations globally, return to ‘normal,’ and prevention of any new variants.

After the trough and quick recovery, though, the consensus view from many economists seems to be that we’ll eventually revert back to the 2.0-2.5%-ish growth range of the past decade. Shorter-term disruptions aside, long-term growth is driven by such things as demographics, labor force size, and productivity. As seen by the chart below, overall U.S. GDP growth has been on a steady downward trend in keeping with these factors.

Source: U.S. Bureau of Economic Analysis, FocusPoint Solutions calculations.

Inflation

With headline and core CPI coming in at 5.0% and 3.8% on a year-over-year basis for May, respectively, there is no doubt that price pressures have risen. The debate at present is whether this change is: (1) a ‘transitory’ effect caused by the pandemic recovery, and related supply and commodity input bottlenecks making their way through the system; or (2) the start of a longer-term sustained uptrend in secular inflation brought about by extreme government monetary accommodation and fiscal spending.

There is no answer yet to how this inflation debate resolves. Based on interpolated TIPs yields quoted by the Fed, the 5-year inflation rate 5-years from now remains at 2.3%, suggesting minimal moderate-term pressures. Longer-term trends that were in place prior to Covid have not changed—as lower overall economic growth (even in maturing emerging nations like China), less favorable demographics (unless aided by immigration), and the deflationary impact of more pervasive and more efficient technology, have pushed secular inflation downward.

Also, there are differences between the PCE inflation indicator the Fed uses, and the standard CPI used by most people (and inflation-linked bond markets and pension adjustments). Due to the different composition of PCE (smaller housing weighting for one), it could look tamer than CPI for a time.

Employment

The Fed’s dual mandate, of price stability and low unemployment, can lead to potential conflicts in implementation. While the stronger recent inflation numbers and improved growth would steer the Fed to let up on the gas pedal, and even think about the brakes, labor dynamics have been slower to improve. The Fed’s unemployment rate expectation for this year is unchanged at 4.5%, and little changed for coming years, at below 4%. Conditions are better than they were, but remain well below pre-Covid levels—particularly in hard-hit services like travel, restaurants, and other recreation. The lower-wage nature of these jobs has created a challenge for policymakers, and something mentioned many times by government officials as ‘economic inequality’ has taken on greater focus. This repair-in-progress would point to a Fed staying easy on policy for longer, despite consequences elsewhere.

Markets have experienced quite a year, with a severe Spring 2020 drawdown, followed by a sharp and relatively quick recovery. As markets usually do, they try to guess the future in advance. So, higher valuations have been followed by a slower backfill of stronger fundamentals (which incidentally have been far better than expected, if measured by corporate earnings.) The coming quarters offer fewer opportunities for ‘easy’ comparisons compared to last spring’s lows, so dramatic surprises on the upside become less likely. However, conditions are still recovering, that such an environment has tended to remain bullish for risk assets, although expectations should be tempered. The world outside the U.S. has been hit harder by the pandemic, with more inconsistent economic recovery, along with accompanying lower/more attractive asset valuations, which offer opportunities going forward.

Bond yields have been expected by many to rise, but this has been predicted for over a decade without success. In fact, the yield on the 10-year Treasury has already fallen back a quarter-percent from its high point of 1.75% in March. The recent fall in yields appears to be due to both tempering in long-term inflation fears, as well as the falling probabilities of President Biden getting additional (expensive) stimulus packages through Congress. Also, the higher U.S. treasury rates get (for bonds seen as the safest asset in the world), the more interested foreign buyers become, whose domestic bond options yield far less, if an above-zero rate at all. As a contrary view to rate rise expectations, if the above-noted secular trends of relatively modest growth and inflation drifting back to normal unfold, one could see a potential path for ongoing lower rates (again).

An important backdrop is that higher interest rates mean larger debt service payments for the U.S. government. Currently, interest payments represent about 2-3% of GDP, more in line with the 1960’s, and about half of the 5% of GDP this ratio reached during the 1980’s-1990’s. Although not a stated Fed objective, higher interest rates would certainly be more problematic for debt coverage ratios (just as they would for an individual company). On the negative side, higher inflation readings compared to recent years could make low/negative real interest rates a reality for some time, were they to persist.

Of course, risks are also present, with richer stock and credit valuations relative to history, offering less room for error if conditions derailed from their positive track. This could be a virus variant taking hold and/or stagnation in vaccination rates (which seem to have slowed sharply, with incentives in the form of lotteries, savings bonds, beer, and cannabis now being offered). If herd immunity is not achieved in the population, the risks increase for later Covid flare-ups. Regardless, reopenings are steadily occurring across the U.S., which has started to normalize conditions and expectations. All-in-all, with the past year as perspective, things aren’t so bad.