There are financial terms that, as advisors, we often use as if they are a part of everyday conversation. Some clients will get a bit giddy when we use terms like asset allocation, beta, correlation, and diversification. The other 95% will nod their head as if in agreement while thinking, “Please make it stop!”

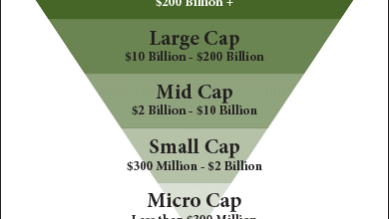

As part of our “There is no such thing as a stupid question” series, the intent of this article is to demystify the three main market capitalizations: small-cap, mid-cap, and large-cap. There are two sub-categories. Mega-cap represents the largest of the large-caps and micro-cap represents the smallest of the small-caps. To keep it simple, I am going to stick with small, mid, and large for this article. The graphic to the right can help put it into perspective.

As advisors, we will frequently use these terms when reviewing the allocation and diversification of our client’s accounts using phrases like, “We are currently underweighting small-cap while overweighting large-cap.” For those of you who are beginning to think “Please make it stop,” stay with me a bit longer.

A company’s market capitalization is calculated by multiplying its outstanding shares by the share price. Let’s take Microsoft for example which, on February 12, 2018 and in rough numbers, was trading at $90 per share and has 7,700,000,000 outstanding shares. Microsoft’s market capitalization is then $90 multiplied by 7,700,000,000 = $693,000,000,000. Yes, that is 693 billion dollars. Every time I read that I want to place my pinky to my mouth, raise my eye-brow, and say it like Dr. Evil from Austin Powers.

Large-cap companies are those whose market capitalization is $10 billion and above. The following are a few examples of large-cap companies with their approximate market cap.

Apple: $816 billion

Johnson & Johnson: $369 billion

Tesla: $59 billion

Mid-cap companies are those whose market cap is between $2 billion and $10 billion. For example:

Bed Bath and Beyond: $3 billion

Myriad Genetics: $2.5 billion

Small-cap companies are those whose market cap is under $2 billion. For example:

Schnitzer Steel Industries: $1 billion

Willamette Valley Vineyards: $40 million

Companies tend to start small and, if successful, continues to grow. Tesla crossed from small-cap to mid-cap in late 2010 and is now a large-cap company. The flip side is that not all companies continue to grow or even remain in business. Just think of Blockbuster Video, Delorean Motor Co., and Borders. Looking at the big picture and excluding Enron and WorldCom from the example large companies pose less investment risk than medium size companies and medium size companies pose less investment risk than small companies. That is a good segue for a future article, “What is the correlation between market cap and market risk.” I’m sure you are all waiting on the edge of your seat for that installment.

Capitalization values are as of 02/12/2018 and provided by YCharts.