Happy New Year! We hope this note finds you happy, healthy and ready to take on 2018. We’re happy to bring you our take on the last quarter of 2017 and a yearend portfolio review.

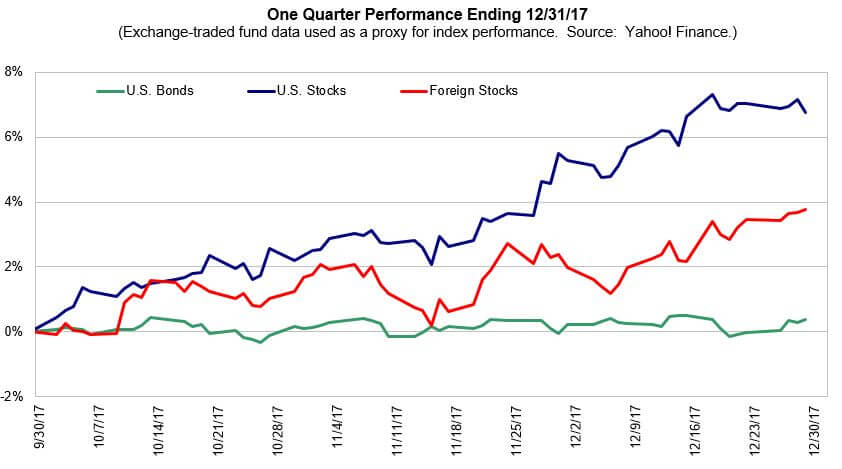

The last quarter continued in the 2017 theme, with equity markets continuing their upward climb and fixed income staying relatively flat. Foreign equities underperformed U.S. equities during the quarter, but as you can see on the annual chart below, outperformed their U.S counterparts in 2017.

Early in the year, we watched the stock market rise in anticipation of relaxed regulations and increased infrastructure spending as promised by the new administration. While many of those campaign promises have yet to come to fruition, companies still continued to do well, enjoying the increased attention from investors. Over the year, companies continued to grow their earnings and slowly backfilled the anticipatory run up with actual profits.

While it’s true that short-term interest rates rose three times in 2017 (0.25% each), longer-term rates declined several times due to low inflation and other economic factors. What does that mean? It means we’re ending the year about where we started, with the 10-year treasury around 2.4%.

2017 Investment Review

Fixed Income

We continued our tilt toward corporate debt over government debt, which has been an effective strategy to seek better performance in this low interest rate environment. Several times throughout the year, we took steps to move away from some of our high-yield positions. These played an important role in your portfolio, offering a better return and diversification, but they ran their course and the reward was no longer worth the risk. We exchanged a portion of your high-yield fixed income holdings to short-term debt positions that feature floating rate bank loans, which move quickly with rising rates.

Foreign bonds saw strong returns due to the declining U.S. dollar. In many cases, the mutual funds in this category outperformed local currencies, but underperformed when translated back to the U.S. dollar. With this in mind, we further diversified foreign bond holdings in June in order to seek a better return while reducing volatility. Overall our fixed income strategy was successful, yielding positive returns in a time when it can be a challenge to reap the reward of a conservative strategy.

Equities

Your U.S. Large cap stocks enjoyed a very strong year. We sold on some of the growth positions in your portfolio (namely in technology and healthcare fields) and invested the proceeds into more value-based sectors of the equity markets. As for mid and small cap positions, there were mixed returns throughout. This year, we focused on some of the larger companies within the mid-cap positions which paralleled the performance of the large cap companies in many ways. The small cap positions in your portfolio outdid the broader market, but underweighting them in favor of large cap proved to be a helpful move.

You might be surprised to learn that foreign equities were the rock stars of 2017. They were the best performing asset class, with long-held positions in both developed and emerging markets doing well.

Alternatives

Both U.S. and foreign real estate did well during 2017. The influence of a smaller holding of global real estate benefitted from the weaker dollar and strong growth prospects in Europe and Asia.

Your commodity holdings provided positive returns for the year, did well versus their broader benchmark. This was due in part to a higher weighting toward metals and a lower lean on energy.

Our Outlook for 2018

After the bull market celebrated its 8th birthday last spring, many of you have asked us “Just how long can things can go up?” After all, this is the second longest bull market in recent history, and the longest since the tech bubble burst in 2000. As we’ve sat across the table from you, we’ve celebrated the market highs with cautious optimism. The end of a business cycle is often clear only in hindsight. At the moment, we’re not seeing any of the normal economic signs that would cause us to think a recession is near. Employment is high, housing starts continue to grow and manufacturing is up. We anticipate strong performance from the stock market in the meantime, thanks to the economic and earnings growth mentioned previously. New, lower corporate tax rates, may encourage businesses to continue that trend.

From an interest rate perspective, we glimpse at the yield curve to get an idea of expectations moving forward. When the yield curve is normal, short term interest rates pay less than long term interest rates. At the moment, the yield curve is still positive, but has flattened somewhat, meaning that investors aren’t expecting to get that much more for a long term investment as they do for a short term investment. The flattening may be due to the offset of the Fed driving interest rates up a bit on the short side and low inflation expectations holding down rates on the long side. In 2018, a new Fed chair will step into Janet Yellen’s role, but historically speaking Jerome Powell as closely agreed with Yellen’s policy of patience and data-driven decisions. At the moment, there are three more interest rate increases expected for 2018. These increases (assuming they fall in the 0.25% range as the past three have) are so highly anticipated that we feel most investor reaction has already been priced into the market.

That said, a market correction in 2018 would not surprise us. Not because of any fundamentals flashing warning signs, but because we know that market pull backs and corrections are part of a normal, healthy stock market. As a matter of fact, we have had 16 such events since the bull started in March of 2009. With current economic data, we anticipate any pull back or correction would be relatively short lived. Trying to time the market is a fool’s game. Instead, we’re focused on reducing volatility by reducing your exposure to the more volatile, growth equities in favor of more balanced exposure, including a tilt to stocks with higher dividend income and lower volatility.

Another way we’re reducing volatility for many of you is by raising a years’ worth of cash early in the year. This is a good fit for those of you who take monthly distributions to support your cash flow needs. If and when that correction comes, you’ve already sold the assets necessary to meet your needs during a market high, rather than having to continually sell assets during a correction.

2018 Tax Reform – What You Need to Know

On December 22nd, Donald Trump signed tax reform that will become effective in 2018. The final bill closely mirrors the House and Senate bills with some compromising. Here’s a brief summary of the top changes that are most likely to impact you. We recommend coordinating with your tax professional early in 2018 to evaluate whether changes to your usual strategy would be beneficial. We’re here to help!

| Tax Imposed | ||

| 2017 | 2018 | |

| Tax Rates | Seven tax brackets:

10%, 15%, 25%, 28%, 22%, 35%, 39.6% |

Seven tax brackets:

10%, 12%, 22%, 24%, 32%, 35%, 37% |

| Capital Gains | Three brackets:

0%, 15%, 20% |

Unchanged, but tied to new tax rates listed above. |

| AMT | Imposed when minimum tax exceeds regular income tax | Increases AMT exemption amounts and phase out. |

| Gift and Estate Tax | Gifts / Estates over $5.49M per person subject to tax up to 40%. | Lifetime exemption increased to $10.98M. |

| Deductions, Exemptions & Credits | ||

| Standard Deduction | $12,700 Married Filing Jointly

$6,350 Single |

$24,000 Married Filing Jointly

$12,000 Single |

| Personal Exemption | $4,050 per person | $0 |

| State, income/sales & property taxes | Allowable as itemized deductions | Deduction for property and income (or sales) tax limited to $10,000 |

| Mortgage Interest | Deductible up to $1.1M of debt; interest on second home deductible | Deductible up to $750,000 of debt (including second home); no home equity interest deduction. |

| Medical Expenses | Deductible to extent they exceed 10% of AGI (7.5% for those 65+) | Deductible to extent they exceed 7.5%

of AGI for 2017-2018, then back to 10% |

| Alimony | Deductible to payor

Taxable to recipient. |

Not deductible to payor

Not taxable to recipient |

| Other Misc. Changes | ||

| Health Insurance Mandate | Penalized for failure to carry minimum health insurance coverage | Repealed |

Miscellaneous

We know you’re all eager to receive your 2017 tax documents; so are we (we like to stay on the good side of our CPA friends!). Around mid-January, Fidelity releases an estimate of when they think tax documents will be distributed. If history is any guide, we expect those mid-late February.

We’re a few months into our once-monthly email summary to help keep you up to date with our blog. How are we doing? What would you like to read about? How can we make it better? Shoot us your feedback at salem@thehgroup.com. If you would like to get updates more than once a month, be sure to follow us on Facebook. Posts show up there immediately after they’re written.

Thank You

Thank you for all the ways you support us with your continued confidence and business. Whether it’s dusting off your long term financial plan, consolidating your accounts to make life simpler or just coming in for a financial checkup – we hope you’ll reach out if there are ways we can help support your wishes for 2018. Happy New Year!