We don’t know about you, but there are days when we envision getting far away from the news and the disquieting things we hear each day. Fortunately, and we’ve mentioned this before, the economy and the various capital markets don’t rely solely on what’s happening in Washington. As Will Rogers reminded us so many years ago:

We don’t know about you, but there are days when we envision getting far away from the news and the disquieting things we hear each day. Fortunately, and we’ve mentioned this before, the economy and the various capital markets don’t rely solely on what’s happening in Washington. As Will Rogers reminded us so many years ago:

“This country has gotten where it is in spite of politics, not by the aid of it. That we have carried as much political bunk as we have and still survived shows we are a super nation.”

We could substitute “economy” for “country” and really not be far off. It is all of us that paint the broad economic picture and, for the most part, we’re all going to keep on doing what we do: creating value in our workplace and purchasing the goods and services we need to take care of our families and secure our wellbeing.

Interest Rates

The Federal Reserve announced another rate increase last week, the 8th since the recovery began in the spring of 2009. The pace of interest rate increases has been deliberate and measured. This has done much to take the sting and surprise out of climbing rates. While we will see these rate increases ripple through the economy in a number of areas, this process has been much anticipated and has not seemingly contributed to stock market volatility in the same way that rate increases have done in the past.

The Federal Reserve announced another rate increase last week, the 8th since the recovery began in the spring of 2009. The pace of interest rate increases has been deliberate and measured. This has done much to take the sting and surprise out of climbing rates. While we will see these rate increases ripple through the economy in a number of areas, this process has been much anticipated and has not seemingly contributed to stock market volatility in the same way that rate increases have done in the past.

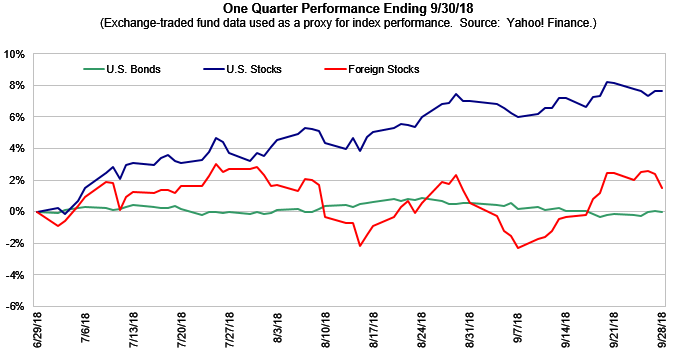

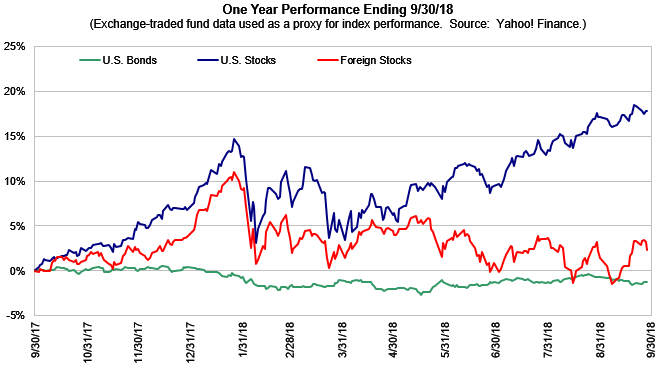

These rate increases are a double-edged sword for bonds in your portfolio. Rate increases tend to make the value of bonds drop a bit, but at the same time those higher rates will eventually appear in the increasing dividend yield of bond funds. The near-term lackluster performance in various sorts of bonds will tend to be offset over time by these higher yields.

Trade Tariffs

The much ballyhooed tariffs are a horse of a different color. Tariffs end up being very similar to a tax increase, essentially raising the price of goods that are affected by the particular tariffs. While it is hard to say exactly what sort of damage or benefit will come from these actions, we tend to agree with many mainstream economists that they will have a dampening affect overall on the broader economy and inject non-market inputs into the global trade equation.

This, of course, can create winners and losers, not based on competition but rather at the whim of one government or another. We’ve seen this play out so far in some predictable and some not so predictable ways. Stay tuned on this one; we’ll all be watching to see how this continues to play out over the months ahead.

Portfolio Overview

As we have talked about over the last year, we have taken a more defensive posture both in the bond and stock component of your portfolio. In bonds we’ve upgraded overall credit quality by stepping away from long held positions in high yield (junk) bonds. On the stock side of your portfolio we moved away from some of the higher growth and more volatile issues and increased the portion of the portfolio invested in value securities with an eye toward modestly reducing potential future volatility.

As we have talked about over the last year, we have taken a more defensive posture both in the bond and stock component of your portfolio. In bonds we’ve upgraded overall credit quality by stepping away from long held positions in high yield (junk) bonds. On the stock side of your portfolio we moved away from some of the higher growth and more volatile issues and increased the portion of the portfolio invested in value securities with an eye toward modestly reducing potential future volatility.

While this last quarter has not seen further movement along this theme, we are likely to take additional steps early next year once the tax picture and gain distribution parameters become more widely known.

Outlook

Continued earnings growth has had a beneficial effect on equity valuations as stocks have spent part of the year “growing into” the prices set by the market rally of last year. Nonetheless, we’ve seen substantial returns in US stocks of all sorts so far this year. International issues have had a much tougher time with prices in emerging markets falling into bear market territory and the strong dollar hurting returns on international investments to US investors.

Looking forward, many expect earnings to continue to grow, perhaps not as fast as they did in 2017, but at a desirable pace nonetheless. In a nutshell, growing earnings could translate into higher stock prices and so this, the most distrusted bull market in recent memory, might just continue for another round or two. Seemingly, there is no sign of recession on the horizon as yet, and we might just see another year or so of growing incomes and reasonable market returns.

Given current conditions, it seems prudent to expect continued good things while at the same time making sure we are prepared for the worst.

Overall allocations along with cash reserves and the timing of larger outlays are key to this preparation in your portfolio.

Planning is the key, and we’re happy to review options with you if you have additional concerns, or if things have changed since we last touched base.

Miscellaneous

- Many of you over 70.5-years-young recently received a letter from Fidelity regarding your required minimum distribution (RMD) for 2018. These letters went out whether or not you have a plan in place to fulfill your RMD for the year or have already fulfilled it. As we do every year, we are keeping a close eye your RMD. If you haven’t taken yours and don’t have a plan in place for a withdrawal before yearend, you can expect a call from us during the fourth quarter. Of course, if you have questions or concerns, please don’t hesitate to reach out.

- Thank you for you continued confidence. The trust you place in us to manage your nest egg and guide you on financial matters is not a privilege we take lightly.

- Best wishes on a fun, fulfilling, stress-free holiday season!